This includes folks claiming Disability Living Allowance, topic to approval. However, we can’t assure you’ll get a automobile loan as everyone’s circumstances are totally different. From the age of 18, you can be eligible for car finance, both with the help of a mother or father or friend as a guarantor, or – if your credit score rating is powerful enough – by yourself.

Cost is a huge issue, whereas any bodily limitations or mobility issues you have add an additional dimension to the problem of discovering an acceptable model. On balance though, the freedom that a automotive can deliver could make a life-changing distinction, and that’s where Motability comes in. We’re dedicated to offering you with a quality service, so calls could also be recorded or monitored for training functions and to assist us develop our companies. MoneyHelper is the new, simple approach to get clear, free, neutral assist for all your cash and pension decisions.

I Have Been Refused Finance By Motonovo

If you’ll have the ability to’t find what you want, don’t worry as we supply cars nationwide. Lenders do not want the headache of chopping your leasing contract brief or chasing payments. They would sooner see written proof of your ability to decide to month-to-month funds. If you are a new enterprise and have little or no credit history, getting automobile finance can sometimes appear impossible. When lending money, finance companies must be confident that you’ll pay them back. They assess this confidence in the type of a credit score score; so for a finance firm to agree to your lease, you will need an excellent score.

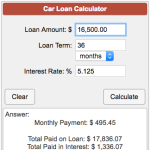

How a lot would a 30 000 car price per month?

A $30,000 automobile, roughly $600 a month.

We might even help you find finance if you’ve had a CCJ, default or IVA up to now. With us, you possibly can secure your loan first and head to the dealership to choose a model new car with confidence. If you’ll be able to, wait before making a model new utility that would go away a tough credit score search on your file. Too many exhausting searches in a brief while might make it tougher so that you just can discover finance sooner or later.

No Credit Automobile Lease

If you are young and haven’t got a regular income, or a history of repaying credit score, then your chances of being accepted for finance may be quite low. In this situation, a guarantor automotive mortgage can open the door to finance, helping you to get into a better car. Credit firms view a lease deal in an analogous approach to a loan. However, quite than the mortgage amount being the same as the value of the automobile, will most likely be equal to the entire quantity of funds. Because we use most of the UK’s most competitive automobile finance corporations, we are capable of provide the most appropriate leasing contract to swimsuit your requirments and your pocket. Why not let us give you the greatest deal and assist make positive you pay as little as attainable on your chosen car.

With EVOGO, you’ll be able to drive the most recent makes and fashions with out the value of ownership or the burden of a prolonged lease. •Details of your credit settlement might be recorded with credit reference businesses. It is dependent upon the sort of finance you’ve and the place you might be within the contract. Some types of finance let you return your automobile early, but there are guidelines to contemplate. Then your automobile wants valuing which is super easy with our Sell Your Car tool. All you have to do is enter your registration number and a few additional particulars to obtain a valuation value in minutes.

Your Rights When Repaying Hp Early

A number of engineering, finance, legal and production roles can be found, just as a 12.3% pay rise has been confirmed for JLR staff. Use any worth above the GMFV as a deposit in opposition to one other automotive. Aidan Rushby, co-founder of Carmoola said that despite the very fact that Britons as “getting savvier” in terms of methods they will get financial savings, refinancing their automobile was a “real blind spot”. A additional one in six also believed that after a person takes out an settlement on a car, they are locked in that agreement for life. The Wednesday assertion added that the membership appreciates the “inconvenience, frustration and disappointment” supporters are feeling, and that every effort is being made to expedite the method. Fans on social media were appalled at the risk of fellow supporters taking out a high-interest loan amid the cost-of-living disaster for a League One season ticket costing as much as £468 for an adult.

Both contain a deposit – though this could usually be very small or even zero in lots of cases – adopted by a series of monthly funds, however there are important differences between them. Alternatively, you could go for Hire Purchase, which has higher month-to-month funds, but you automatically own the car once you have made the last one, with no huge lump sum to pay at the finish. Anyone making an application to lease a car has to demonstrate they’ve enough income to pay for the month-to-month instalments. If you could have unfavorable credit ratings however can afford the funds, you could be asked to point out your final three wage slips.

Hp Faqs

If you’re going through financial troubles, you must seek the guidance of an independent monetary advisor. Your options may be limited, and some lenders may increase interest rates for those with unfavorable credit score ratings. This guide will stroll method to get the best cope with a poor credit score rating.